What to think about when creating a sustainability report

As part of the Cambridge Independent's Masterclass series of expert insights, we offered inspiration and advice to those looking to measure and report on their company's sustainability.Following a huge rise in requests for sustainability reports over the past few years, we have learnt what works and what does not when it comes to sustainability report design, as we show in this article.

Sustainability reports: Inspiration and advice

Trends in the way that companies and organisations report financial information and other performance indicators are constantly changing. We have produced hundreds of annual reports over the last decade for organisations in the UK and the US, including Ernst and Young, GSK, Silicon Valley Bank and Systemiq Capital. In the past few years, our agency has seen a huge rise of interest in sustainability reporting, both within general annual reports and as standalone environmental, social and governance (ESG) impact reports.

According to Managing Director, Mario Prelorenzo, annual and ESG reporting is about more than fulfilling a regulatory requirement: “It’s a legal obligation for all limited companies in the UK to produce an annual report, and at JDJ Creative we see this process as an opportunity to give a valuable insight into the heart of a company. Annual reports can be used to engender trust and reaffirm purpose amongst all stakeholders including investors, board members, staff and customers. Measuring and reporting on metrics related to ESG factors is a great way to bring a long-term sense of purpose into focus.”

Sustainability reporting legislation

Most companies are not yet legally obliged to report on sustainability measures, but there are indications that this will change soon. The UK government introduced mandatory climate change reporting rules for large corporations in April 2022. These rules currently apply only to the UK’s largest traded companies, insurers, and banks, as well as private companies with over £500 million in turnover and 500 employees. However, many industry experts believe that they will be extended to apply to small and medium-sized businesses (SMEs) too, meaning that all organisations may be affected in the future.

European regulations are changing too; new EU reporting requirements are being introduced as part of a ‘European Green New Deal’, which aims to make Europe the first climate-neutral continent by 2050. The Corporate Sustainability Reporting Directive (CSRD) directive strengthens the rules on reporting ESG information and broadens the set of companies required to comply. The European Parliament estimates that the number of companies legally obliged to comply will rise from 11,700 to 50,000. Regardless of current legal obligations, many of our clients already choose to invest time and money into developing their processes for sustainability reporting.

How should companies measure their ESG and sustainability performance?

In the UK, new performance indicators have been proposed by the Taskforce for Climate-Related Financial Disclosures (TCFC), which was set up with the aim of creating a single standardised framework to encourage accountability across all industries and sectors. The TCFD proposed new Sustainability Disclosure Requirements (SDRs) around four pillars — Governance, Strategy, Risk Management, and Metrics and Targets. Other measurement methods exist, and the most popular framework in the world is provided by the Global Reporting Initiative (GRI) which proposed a list of standards to show impact on the environment, society and the economy. Other approaches have been proposed by the Sustainability Accounting Standards Board (SASB) and the Integrated Reporting (IR) Framework. The framework that your company chooses will depend on factors such as the regions that you trade in and your type of industry. JDJ Creative can help clients decide which measurement factors to include in their reports (see our list for initial ideas).

What to include in a sustainability/ESG report?

- A statement from the CEO outlining your policies on environmental, social and governance factors

- A graphical representation of the company’s structure and business model

- Your sustainability goals within the context of your industry (transport, energy, materials, biodiversity)

- Performance over time, including KPIs and metrics e.g Tonnes of CO2 saved by you or your customers, reduction in aviation miles, reduction in energy bills, education initiatives to change behaviour

- Positive stories about changing behaviour to reduce negative impact

- Include additional positive impacts in the community such as volunteering or fundraising to support local charities

How to present an ESG report that inspires stakeholders

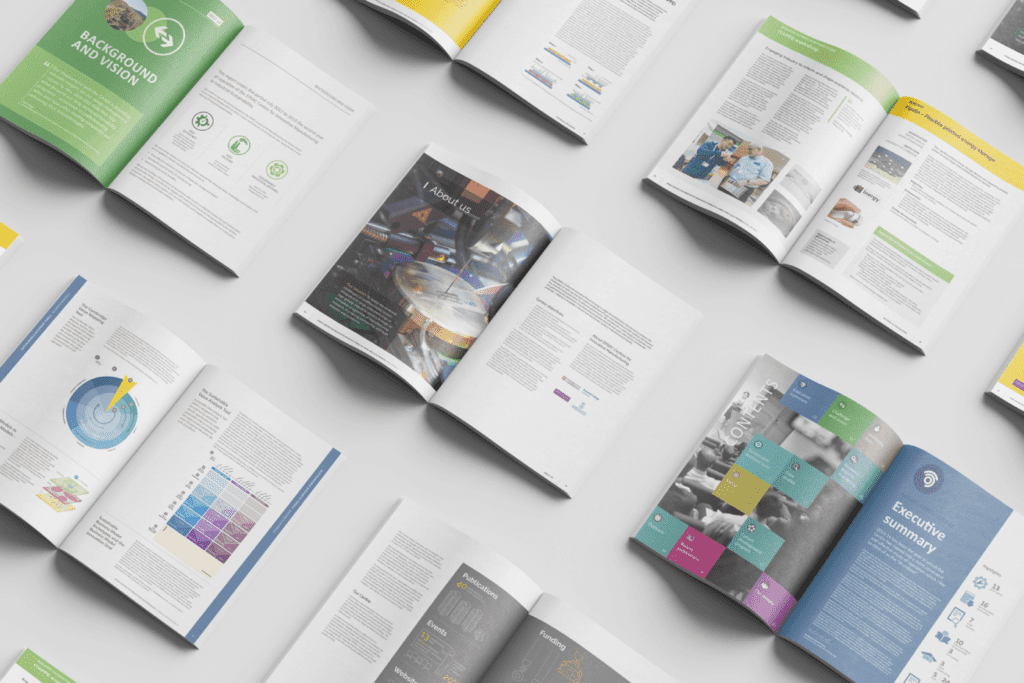

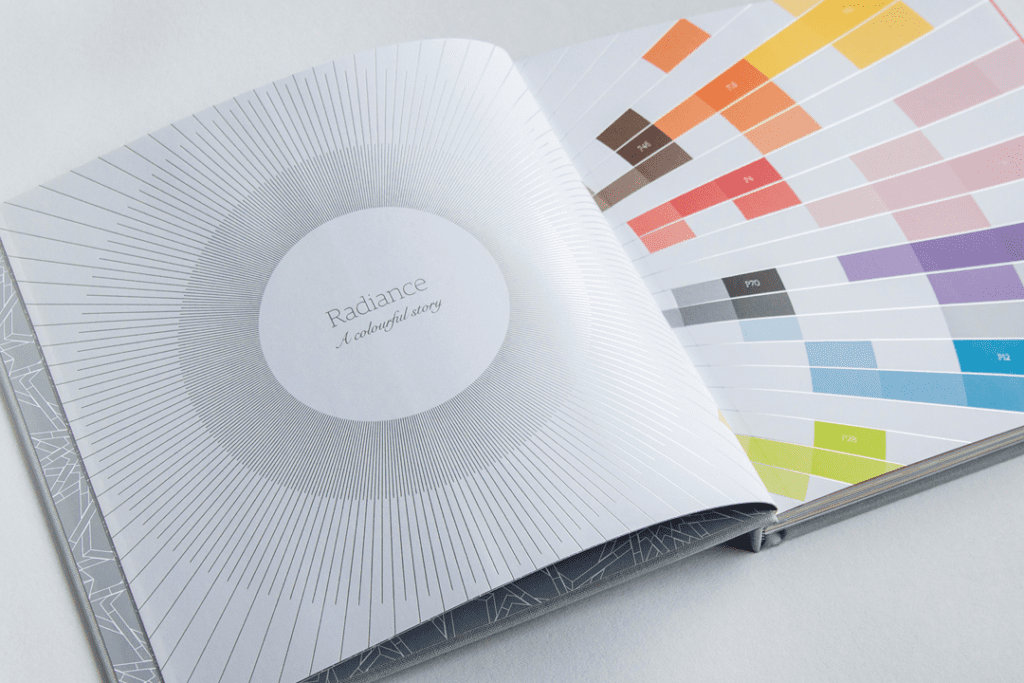

Our Founder and Creative Director, Jean Prelorenzo, works with clients on brand identity and the visual communication of their values, including ESG targets. She said: “Sustainability reporting is an opportunity to inspire your stakeholders by showing long-term value in a clear and attractive way. The data that you want to share is sometimes hard to present without using spreadsheets full of numbers, or never-ending PowerPoint presentations. Our designers suggest ways to show your impact in a clear, concise and engaging way. We might suggest using digital pdfs, microsites, infographics and case studies. By mixing raw data with engaging narratives, we help clients appeal to multiple audiences and bring them together with a common sense of purpose. Even seemingly small decisions about colours, typeface, infographics and imagery play an important role in increasing engagement and ensuring that information is easy to understand and to compare year on year.”

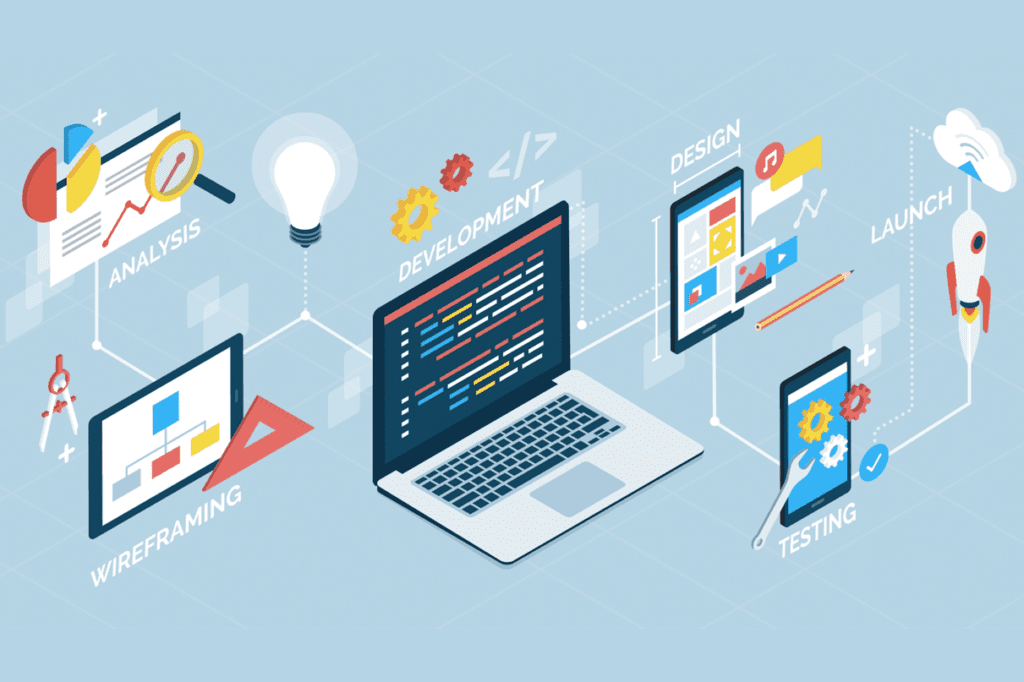

She continued: “Over the years, we’ve improved our processes to ensure as seamless a client experience as possible. This includes project management tools, step by step internal processes, quality control, proofreading and editing. We’ve grown from a small team of designers to a full-service creative agency. It’s exciting to manage projects from initial concept discussions through to completion.”

On the future of sustainability reporting, Mario Prelorenzo said: “We always advise clients to start thinking about this issue now to get ahead of the curve. Investors, regulators and stakeholders are increasingly interested in ESG and sustainability performance, so broadening the scope of your reporting now is a good way of showing everybody that you’re agile and prepared for the future.”

Jessica Stewart, Chief Operating Officer of

Jessica Stewart, Chief Operating Officer of