In summary...

As governments around the world sign up for challenging environmental commitments, so transparency in sustainability reporting continues to increase in importance.

With the negative effects of global climate change and an increasing awareness of inequality amongst this generation of consumers, sustainability has become one of the most important issues facing humanity today.

What is sustainability reporting?

Like the financial information included in an annual report, sustainability reporting provides an opportunity for businesses to communicate their performance over the previous reporting period, from an environmental, social and governance (ESG) perspective.

ENVIRONMENTAL – An organisation’s impact on the environment, including carbon emissions, waste, pollution, and broader environmental issues, such as biodiversity.

SOCIAL AWARENESS – The impacts on employees and local societies, including wellbeing, equality and human rights.

GOVERNANCE – Accountability for decisions that affect the long-term sustainability of the organisation, usually at the director level.

Presenting this data compels businesses to measure their environmental impact and examine their management structure, community relations and ethos towards staff. This then provides them with useful insights from which they can set specific, measurable, attainable, relevant and time-based (SMART) goals, thus allowing them to improve their environmental and societal impacts in the future.

This data can then additionally provide transparency and accountability between a company and its external stakeholders, improving communication and engendering loyalty and trust.

Does my business need to produce a sustainability report?

While currently, most sustainability reporting is voluntary, in the future, inevitably, it will become a legal requirement.

Most recently, the UK has set out new Sustainability Disclosure Requirements (SDR) as part of its Green Finance Strategy, advancing its ambition to be the first country in the world to make the Task Force on Climate-related Financial Disclosures’ (TCFD) aligned disclosures fully mandatory across the economy, with most measures planned to be in force by 2023.

Meanwhile, the EU has updated its Corporate Sustainability Reporting Directive, making the introduction of mandatory sustainability reporting standards a requirement for all large and listed EU companies.

Therefore it is advisable for businesses of all sizes to understand their responsibilities now, to avoid being caught out in the future.

This is not, however, a new ideal. It’s a change that large organisations have been aware of for a long time. So much so, that over the past 30 years, the number of companies publishing sustainability reports has increased from 12 per cent in 1993 to 80 per cent in 2020. Those companies who are not disclosing, or even monitoring, their environmental, economic and social impacts are missing out on important insights and the opportunity to provide long-term value to their customers and stakeholders.

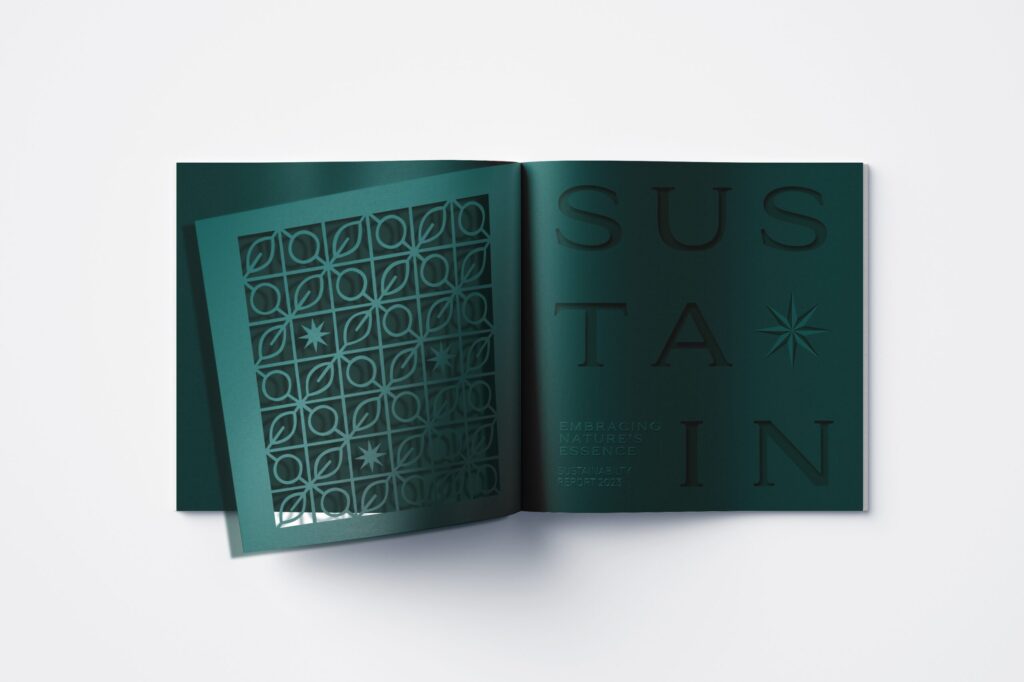

For companies who wish to publish their first sustainability report or those who want to improve their current offering, this guide provides useful design tips that will help you present your data in a clear, concise and engaging way.

We already report on our Corporate Social Responsibility (CSR). Is this the same as ESG reporting?

Because the two terms, CSR and ESG, are similar, they’re often used interchangeably. Indeed, ESG was formed from CSR ideals, but there are differences between the two. While CSR reporting provides an opportunity to highlight positive steps taken to improve employee working conditions or enhance the locality in which your business operates, ESG provides quantifiable data that more effectively measures the impacts of these efforts.

For example, CSR efforts could include programmes such as employee volunteering schemes, awareness days, or recycling policies. While altruistic in themselves, their impact can too often be negligible outside of the positive PR they generate. Often mentioned in passing in an annual report to highlight a company’s sense of community, they don’t have measurable data to back up these claims. This means that, at best, companies struggle to prove the worth of these enterprises. At worst, it could represent deliberate greenwashing of an organisation’s products or activities.

ESG reporting takes this a step further. Because they’re data-led, ESG policies integrate fully into business planning, providing measurable results, which are easily comparable year on year. As investors and consumers become more demanding of companies and their approach to sustainability, this reporting is a valuable tool, which provides actionable insights and results.

Is sustainability reporting mandatory in the UK?

Sustainability reporting is not currently mandatory for most companies in the UK.

However, in October 2021, the government announced new Sustainability Disclosure Requirements (SDR) for businesses and asset managers, setting out a roadmap for all businesses to disclose their environmental impact in the future.

Currently, all UK quoted companies are required to report on their greenhouse gas emissions as part of their annual Directors’ Report. They must also report on their global energy use, under the terms of the Companies (Directors’ Report) and Limited Liability Partnerships (Energy and Carbon Report) Regulations 2018. And, in December 2020, the Financial Conduct Authority (FCA) issued a new Listing Rule, stating that premium listed companies are required to include a statement in their annual financial report which sets out whether their disclosures are consistent with the recommendations of the TCFD, or else explain why they have not done so.